Connecting Massachusetts to the Global Economy

June 3, 2016 – Hosted at Newton Marriott Hotel, Newton, MA

Click here for a PDF version.

Moderator: Curt Nickisch, Senior Editor, Harvard Business Review

Featured Speaker: Michael Dolega, Director & Senior Economist, TD Economics

Panelists (see Appendix A for more information):

- Lorraine Attridge, U.S. Fast Trak Leader, GE Healthcare Life Sciences (Marlborough)

- Colin Gillespie, President, LEGO Education, North America (Boston)

- Charles Gray, Vice President & General Counsel, Teradyne (North Reading)

- Paula Murphy, Founder & Director, Massachusetts Export Center (Boston)

Perspectives on Massachusetts in a Global Economy

Michael Dolega

Commencing the conversation at this year’s MassEcon Annual Conference was Michael Dolega, who highlighted economic trends and indicators that shed light on how Massachusetts stacks up against other economies in terms of trading activity and general competitiveness. Overall, Dolega saw the Commonwealth as being “one of the better performing economies,” but nonetheless pointed out many areas that pose a challenge to future growth and could see further improvement:

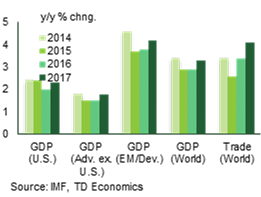

- The Global Outlook. Economic challenges in China and other emerging markets have, as put by Dolega, “caused a fair bit of volatility and potentially thrown the global economy for a bit of a ride.” The impact of this volatility has caused weak global growth, and weighed down prices overall. Despite these factors, the U.S. has performed well relative to other advanced economies which has caused the dollar’s value to increase, putting pressure on U.S. exporters to compete, including those from Massachusetts.

- Massachusetts Exports. Although not immune to the weak global trends, Massachusetts is well positioned moving forward due to the composition of its exports. The share of goods exported from the Commonwealth defined as “high value-added” (pharmaceutical, electronics, machinery, aerospace, etc.) stands at about 65%. Dolega explained that these products are “in demand and will continue to be in demand for years to come,” and because of their capital intensive needs, are “not vulnerable to further off-shoring.” Another positive indicator for the state is its large share of services in the makeup of exports (about 1:1), which have doubled in size nationally since 2005 and are expected to continue increasing.

- Free Trade Agreements. Currently, only about 31% of Massachusetts goods exports are covered under current U.S. Free Trade Agreements (FTA), meaning that 69% of goods are still subject to high tariffs. Two deals currently on the table would bode well for the Commonwealth if ratified: The Trans-Atlantic Trade and Investment Partnership (TTIP) with the European Union and Trans-Pacific Partnership (TPP), which includes Pacific Rim countries such as Japan, Australia, and New Zealand. These deals would combine to remove 30-35% of tariffs that currently work against exports from the Commonwealth. Due to this impact, Dolega explained that “the state has a lot to gain” from these agreements, specifically due to the impact they would have on standardizing trading practices in service industries.

Key Topics and Responses

Why Businesses Choose Massachusetts

“It’s unmatched.” This is one of the ways in which Colin Gillespie described why LEGO Education, North America decided to move its headquarters to Boston this past February. Gillespie felt that access to the global community was paramount to this decision, not just because Boston is a city that can be physically accessed from around the world, but also due to the fact that it is home to an inclusive and diverse population. To support this claim, Gillespie noted that for his European colleagues “[Boston], and perhaps San Francisco, feel the most like Frankfurt, feel the most like Copenhagen, and elsewhere.” Furthermore, Gillespie pointed out that about half of the valedictorians in this year’s Boston Public School system’s graduating classes are students who were born outside of the U.S. Lorraine Attridge, whose company GE Healthcare Life Science also recently moved to Massachusetts (Marlborough), echoed the sentiments put forward by Gillespie, most notably in reference to the state’s high-caliber talent pool. As put by Attridge, “we were able to find some really talented scientists,” adding, “the decision to move to Massachusetts…has really been a huge boost for us.”

Unlike Attridge and Gillespie, Charles Gray had a much different perspective on this topic as his company, Teradyne, was founded in the state and has kept its headquarters here since 1961. “Our problem is how do we stay here,” Gray described. Specifically referencing cost, Gray stated that due to the state’s economic success, “it has become a very expensive place to do business.” That being said, he also noted that in spite of this obstacle, the state is still a place where every company wants to be. Specifically, Gray focused on the recent surge of direct international flights to and from Boston’s Logan Airport saying, “We shouldn’t underestimate how important [that] is, not to just us going out, but to our customers and our suppliers coming in.”

Trade Policy and the 2016 Presidential Campaign

For individuals who believe in, and rely on free trade initiatives for their businesses, the protectionism that has emerged in the current political cycle has been troubling. However, the panelists took a much more optimistic view than may have been expected. As put by Gray, “There’s not much even a new president can do to change [the presence of global trade].” He went on to address the desire to bring manufacturing jobs back to the U.S., which many see as being a main driver of protectionist positioning by politicians. Gray explained that there are two effective ways to address this problem: training and harnessing the industrial automation revolution. Gray emphasized this second point as being “a huge opportunity in this country” to “keep manufacturing competitive.”

The panelists support for free trade continued with comments made by Paula Murphy and Dolega. Dolega shared that, as an economist, he supports free trade agreements, adding that “trade is not a zero-sum game…As long as the rules are written properly…the deals currently being negotiated I think would be very positive for the U.S. economy.” Murphy pointed out that historically free trade has been supported under both Democratic and Republican administrations, referencing that as evidence to be optimistic that this trend will continue. Additionally, Murphy emphasized reforms currently being made to export control initiatives. The U.S. Export Control System was enacted “as a means to promote our national security interests and foreign policy objectives,” and the system “controls exports of sensitive equipment, software and technology.” In 2009, the Obama administration “determined that the current export control system is overly complicated, contains too many redundancies, and, in trying to protect too much, diminishes our ability to focus our efforts on the most critical national security priorities,” and thereafter directed a review of the system’s structure. According to Murphy, the reform efforts that have resulted from this review are “an issue that significantly affects Massachusetts… [because Massachusetts is] the 5th largest exporting state for items that are controlled for export purposes.” Murphy went on to say that the “future of [export control reform initiatives] could be in question depending on what party gets [elected].”

What International Markets Should Massachusetts Businesses Focus on Going Forward?

While the U.S. has seen a shift in export growth toward emerging markets in Asia, Massachusetts has historically lagged behind. As explained by Murphy, this is mostly due to the high value-added goods that are produced in the Commonwealth, which naturally gravitate toward more advanced economies in Western Europe and Canada. However, Massachusetts has made considerable progress in emerging markets over the past five years as a sizeable portion of Massachusetts export growth during that time has gone to Asia. Additionally, Murphy addressed her optimism for new trade potential as diplomatic relations between the U.S. and Cuba continue to thaw. Specifically, Murphy said that niche products such as healthcare have strong opportunities in Cuba as sanction policies change.

Although optimistic about developments and opportunities with Cuba, when asked by Kamran Nafissi of Strategic Workspaces about pursuing business with Iran, Murphy relayed a more cautious message: “There are significant hurdles in place…to do business with Iran,” adding that it is still prohibited for U.S. companies to export directly to Iran. As was with the case with Cuba, the healthcare sector is one area that Murphy mentioned as being a potential industry where allowances could be made, but overall, she explained that due to heavy restrictions, it is still in large part a question of “how do you navigate [business with Iran] so that you are doing it legally?”

Gateway Cities and Beyond: Opportunities in Massachusetts Outside of Kendall Square

Among the attendees at this year’s Annual Conference was Mark Sullivan, Executive Director at the Massachusetts Office of International Trade and Investment (MOITI), an organization dedicated to bringing new economic opportunities to the state of Massachusetts by enlisting global trading partners. As the discussion began focusing on why the Commonwealth can be a challenging location to conduct business, Sullivan took the opportunity to explain to the audience how his office can aid organizations in this process. Sullivan pointed out that in his experience with companies looking to open new facilities in Massachusetts, there is a consistently expressed preference to locate in Kendall Square due to ease of access. However, he describes this as being a “very difficult” task. As an alternative, Sullivan highlighted Gateway Cities which are designated due to their demographic makeup and include the following characteristics:

- A population between 35,000 and 250,000 residents,

- A median household income lower than the state average

- Must contain a rate of bachelor degree attainment at or below the state average.

The 26 cities that qualify for this designation are equipped by the state and local government with robust tax incentive programs to assist businesses, as well as offsets to hiring expenses.

According to Attridge, GE Healthcare Life Sciences has also seen significant benefits to its location in Marlborough. Referencing recent additions to the area such as daycare centers, apartment complexes, and hotels, Attridge proclaimed that areas “out there are trying to build that community spirit so that people…don’t feel like they are way out beyond everything that is happening.” This is especially important to GE Healthcare Life Science’s younger prospective pool of employees, as Attridge said that “they want that community feeling near their workplace.” Gillespie further supported this point, adding that there is “corporate responsibility” on behalf of companies to “change so that [we] can bring out the great in our employees.” Gillespie said that one way to do this is to ensure that workers have access to bicycle storage, wellness areas for their individual private needs, and other similar accommodations.

Capital Investment

A statistic which has caused concern recently is the low levels of real capital investment, which includes investment into assets such as machinery and facilities. Pete Brown, Director of Business Development for Campanelli, addressed this point to the panelists, and suggested that a strategy to draw investment out of company treasuries may be to lower the corporate tax rate. Although Dolega did agree that there are multinational corporations who are hesitant to bring money back into the U.S. due to corporate tax levels, he believes that companies “would [invest in capital] if they felt that the environment required it.” Dolega noted that that the seemingly grim levels of real capital investment may actually not be as poor as they appear, pointing out that investment by industry sectors such as mining, drilling, and gas (which have seen investment decreases ranging between 50-70%) have skewed the aggregate view. By excluding these numbers, Dolega stated there is a “slightly more optimistic…view of what is actually going on.” He continued, saying that “businesses will begin to recognize the fact that they do have to invest in order to make sure they provide these goods and services to the consumer, because the demand is going to be there.”

Educational Institutions are Talent Pipelines, but see downturns in Electrical Engineering Graduates

Educational institutions received strong recognition as the panelists continually credited the academic environment and resulting talent pool as key draws for companies to locate in Massachusetts. One recount that highlighted this view was made by Colin Gillespie, who reflected back on the difficult decisions LEGO Education North America went through when deciding to relocate the organization from Kansas to Boston. As Gillespie explained, the company saw significant growth while at its Midwest location but began seeing signs that growth could not be supported by the region’s talent supply. Realizing this was the case, Gillespie and LEGO Education North America were faced with finding a location that could both sustain the company’s impending expansion while replacing the strong employees who had built the company to its current stature (although every employee had the opportunity to move from the Midwest to Boston, only about 5% of employees chose to do so). According to Gillespie, Boston was able to meet these requirements for LEGO Education North America, as he explained that “the education community here… [can] provide the talent we need for future growth.”

However, one point of critique for the academic community did emerge from Charles Gray as he explained Teradyne’s evolving presence in the state over the past five decades. Gray outlined that as the electronics market has moved west, currently residing in Taiwan and China, his company has been forced to do so as well. One reason for this is cost, but another is that universities in the U.S. have seen a significant decline in electrical engineering graduates. Gray explained that “if you look back to the 1970’s, [Teradyne] hired the top [electrical engineering] majors from MIT and WPI and UMass… and they’re just not producing as many because that doesn’t seem to be a direction the students want to go… If you go to any country in Asia they produce massive [numbers] of [electrical engineering] majors.” Overall, Gray’s comments were accompanied by high praise for the Commonwealth’s educational institutions, but as the economy and global market continues to develop and evolve, students and universities may take his observation into consideration when planning for the future.

Green Light – Red Light

As the 2016 Annual Conference came to a close, moderator Curt Nickisch asked each of the panelists to identify both positive areas (green light) and areas that need improvement (red light) for Massachusetts businesses to succeed. Mentioned on the green light side were:

- Continuing the innovative environment fostered by the state and its institutions;

- Continuing progress already being made towards developing into a world class state and city;

- Strong support in place for biotech initiatives;

- Institutions in place that can help companies of all sizes expand internationally;

- Persistent support for the state’s world leading educational institutions.

On the red light side, areas for improvement which were mentioned are:

- Encouraging more small and medium sized companies to headquarter in Massachusetts;

- Ensuring that protectionist regulations regarding employees do not disrupt the pursuit of becoming a world class location;

- Improving the infrastructure so that it becomes effective and efficient;

- Adjusting regulations so that it becomes less expensive to do business in the Commonwealth.

Thank You to Our Sponsor

Conference Partners: Associated Industries of Massachusetts, MA Economic Development Council, NAIOP, MOITI, MassBio, CONECT, CoreNet

Appendix A

Moderator:

Curt is the Senior Editor at the Harvard Business Review and was the business and technology reporter at WBUR for 10 years. He has received various journalism accolades, including national Edward R. Murrow and Scripps Howard Radio Awards and was a Knight-Wallace Fellow in Education Journalism and Fulbright Journalism Fellow.

Featured Speaker:

Based at TD’s Toronto headquarters, Michael is an economic researcher and forecaster focusing on U.S. industries and regional economics. His areas of expertise include macroeconomic conditions, monetary policy, financial economics, and on-shoring trends in the U.S. manufacturing sector. He is the author of Offshoring, Onshoring, and the Rebirth of American Manufacturing. Michael is frequently called upon by the national economic media to comment on current trends and outlook.

Panelists:

Lorraine is a leader for the U.S. and Canada’s Fast Trak program which helps GE’s bioprocess customers in their process development, optimization and scale-up work. Fast Trak offers consulting, education, and training to help customers in a wide range of topics including Advanced Bioreactor Cultivation Technology, Downstream Bioprocess Development, and High Throughput Process Development.

Colin is the President of LEGO Education, North America, headquartered in Boston and a division of The LEGO Group based in Billund, Denmark. LEGO Education works with teachers and educational specialists to provide solutions and resources that are used in the classroom to bring subjects to life and make learning fun. Colin oversees the company’s American and Canadian strategic growth and has served in a variety of leadership roles within national and multinational markets, most recently developing the long-term marketing strategy for the company’s expansion in Brazil.

Charles is Vice President, General Counsel, and Secretary of Teradyne, a leading supplier of automation equipment for test and industrial applications including semiconductors, wireless products, data storage, and complex electronic systems which serve consumer, communications, industrial, and government customers. Teradyne’s products include collaborative robots used by global manufacturing and light industrial customers to improve quality and increase manufacturing efficiency. In 2015, the North Reading headquartered company employed 4,200 people around the world.

Paula has over 20 years of international experience in the public and private sectors, and is the founding director of the Massachusetts Export Center, a “one-stop” resource for export assistance. The organization provides targeted, high-impact services through a statewide network of international trade professionals to help companies throughout Massachusetts achieve success in global markets. Most recently, Paula launched the Export Center’s Compliance Alliance initiative which provides a forum for exporting firms to share best practices and stay current on export regulatory compliance issues.